what are roll back taxes

Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as nonagricultural property. The roll-back tax occurs because the tax dollars saved under the land use program are only a deferment based on the use of the land.

Biggest Scam In Texas When Elected Officials Pretend To Be Anti Tax But Actually Raise Your Taxes

An example would be when a.

. Changing to a non-qualifying use rezoning to a more intense use Sec. Of rollback taxes instead of five. In 2019 legislation was passed to reduce the number of years from 5 to 3 years in which the roll-back tax could be assessed on a change in special use agriculture and timber.

Effective January 1 2021 rollback taxes on real property converted from agricultural use to some other use will be imposed in the year of change in use and the three. The roll-back tax shall be levied and collected from the owner of the real estate in accordance with subsection D. The taxes on a parcel in the land use.

Simply put this means that property owners who develop their AG agricultural land or sell it to be developed will have to pay two fewer years of rollback. The Roll Back Taxes ballot measure Question 3 was a 2010 citizen initiative in Massachusetts USA to roll back the state sales tax. The rollback tax is the difference between the taxes paid on the lands agricultural value and the taxes that would have been paid if the land had been taxed on its higher market.

In effect rollback taxes pay back the tax savings the owner enjoyed under a greenbelt assessment. Means taxes in an amount equal to the taxes that would have been payable on the property had it not been tax exempt in the current tax year the year of sale or. Roll-Back Taxes are applied when all or a portion of a property that has been receiving the Agricultural Use Value changes classification.

Essentially the rollback tax is the difference between the amount the land owner owed in property taxes and the amount the land owner would have owed had there been no. 581-3237 of the Code of Virginia and the split off or subdivision of lots Title Sec. Roll-back taxes shall be imposed upon the tract of land leased by the landowner for wireless or cellular telecommunications purposes and the fair market value of that tract of land shall be.

For Agricultural and Forest properties the rollback period is three 3 years--the. It was the boldest and most serious threat to high taxes. The rollback taxes can be.

Real property zoned to a more intensive use before July 1 1988 at the.

Split Fayetteville Council Refuses Rollback In Rate Increases Taxes 9 5 The Citizen

Savannah City Council Adopts Rollback Millage Rate Wtgs

Food Input Tax Rollback Urged The Western Producer

Editorial Roll Back California Pot Taxes To Save Legal Market

How To Calculate Texas Rollback Taxes

Mcmillan Pledges To Roll Back Taxes In Anne Arundel County Eye On Annapolis Eye On Annapolis

Woodstock Considering Partial Property Tax Rollback

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XG7G6DT4SENYSHBA3GCD62F25M.jpg)

Is Your Government Running Up The Score In The Last Days Of The Old Property Tax Law By Raising Taxes

Rollback Taxes May Cost Us 100 000 On A Current Land Deal Here S What You Need To Know Rollback Taxes May Cost Us 100 000 On A Current Land Deal Here S

Agricultural Valuations And Rollback Taxes Cip Texas

Nashville Power Poll Power Poll Respondents Strongly Oppose Tax Reduction Referendums Tennessee Lookout

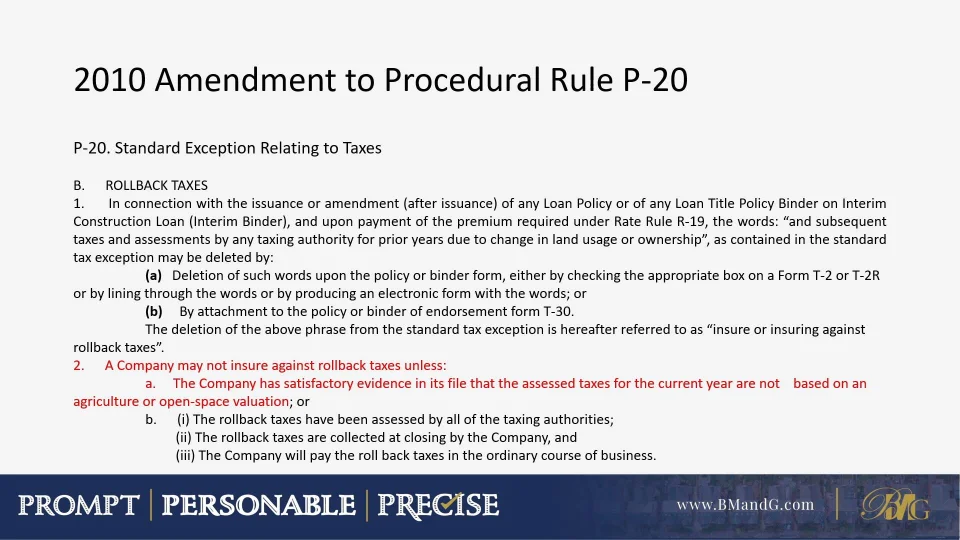

Rollback And Deferred Taxes In Texas Black Mann Graham L L P

Rollback Changes Mean Higher Property Taxes For Residents Despite Lower Rate

Petition Roll Back Taxes On Camera Equipment To Pre Gst 0

Cobb School Board Raises Taxes By Keeping Millage Flat After Failed Attempt To Roll Back Education Mdjonline Com

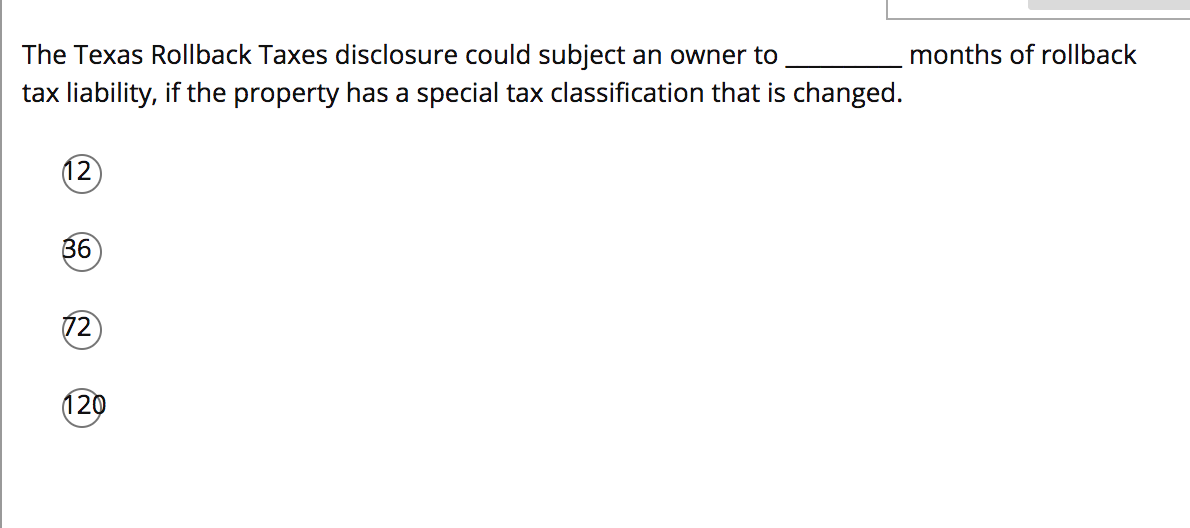

The Texas Rollback Taxes Disclosure Could Subject An Chegg Com

Should Texas Roll Back Or Roll Forward With Senate Bill 2

New York Suspends The Gas Tax For Six Months As Pump Prices Soar